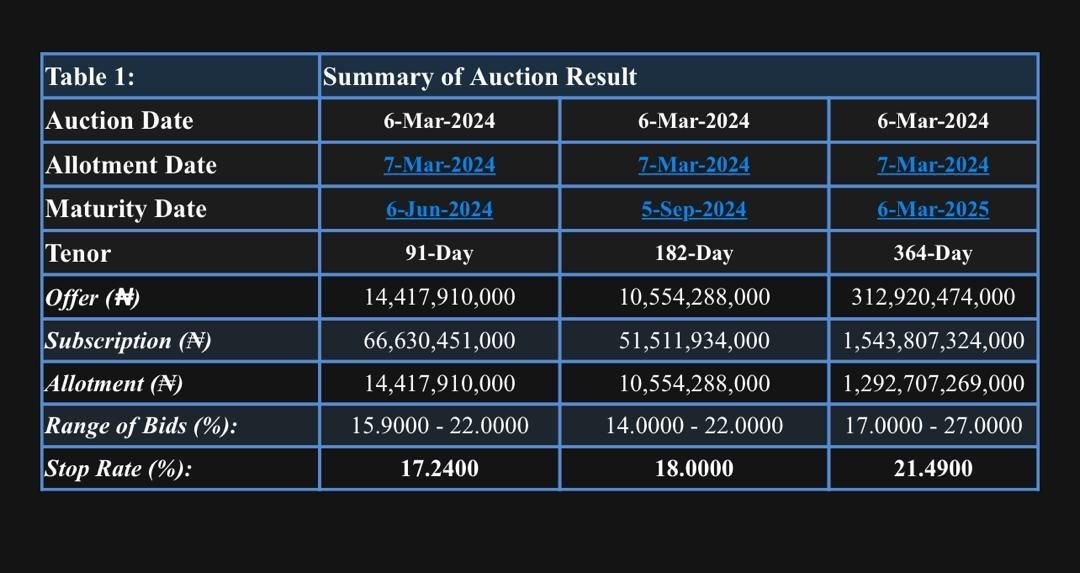

The Central Bank of Nigeria (CBN) has completed another round of Treasury Bills (T-Bills) auction, offloading about N1.3 trillion.

The auction, which took place on March 6, 2024, saw the bills being offered across three different tenors.

According to the Summary of Auction Result, the highest interest, or stop rate, was recorded for the 364-day tenor at a striking 21.490%.

This maturity date is slated for March 6, 2025, and it had an offer of over N312 billion, with subscriptions skyrocketing to nearly N1.54 trillion.

The CBN has successfully allotted the same amount as the initial offer, showing a robust appetite from investors, which has continued to soar in recent times.

In comparison, the shorter tenor T-Bills drew a more modest interest rate, with the 91-day bills closing at a stop rate of 17.240% and the 182-day bills at 18.000%.

The 91-day bills, maturing on June 6, 2024, saw an offer of N14.4 billion and received an oversubscribed interest of over N66 billion.

All the offered amount was allotted to bidders. Similarly, the 182-day bills had an offer of N10.5 billion and were subscribed to over N51 billion. The maturity date for these bills is set for September 5, 2024.

The range of bids for the different tenors varied, with the 91-day bills having a bid range of 15.9000% – 22.0000%, the 182-day bills slightly narrower at 14.0000% – 22.0000%, and the 364-day bills having bids placed between 17.0000% and 27.0000%.

These results highlight the CBN’s continuous efforts to regulate liquidity and control inflation by issuing treasury bills. The high stop rate of 21.490% on the 364-day tenor indicates an aggressive stance by the CBN in curbing excess liquidity, which could be seen as a move to attract more investors to government securities.

By tightening monetary policy through higher interest rates and larger treasury bill auctions, the CBN aims to curb inflation and stabilise the exchange rate, thereby fostering a more balanced economic environment.

The decision to significantly raise the volume of treasury bills auctioned, especially for the 364-day tenure, underscores the CBN’s commitment to addressing the liquidity surplus in the economy.

By absorbing excess liquidity, the CBN endeavours to counter inflationary pressures and support the naira’s value, which is crucial for economic stability and growth.