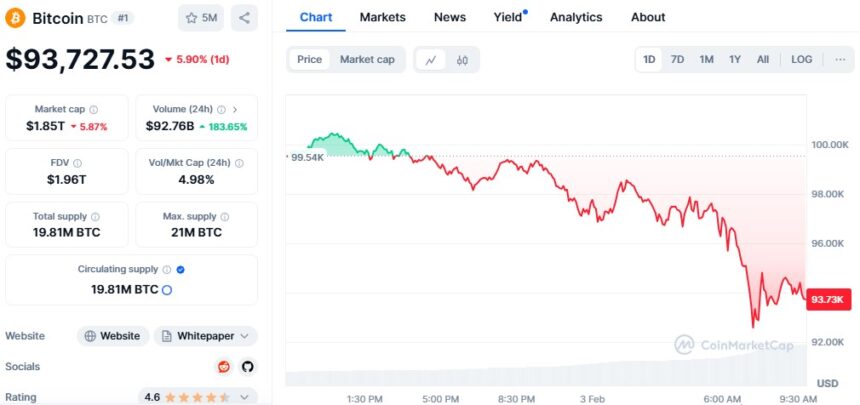

Bitcoin and Ether experienced significant market drops on Monday due to rising global trade tensions. The price of Bitcoin reached its lowest point in three weeks when it settled at $92,580 during early Asian trading before falling to $93,727.53.

Ether experienced its biggest dip since September when it dropped 24% to reach $2,300. Bitcoin experienced a 7% decline over the weekend when it reached $93,727.53 while Ether suffered a 20% drop reaching its lowest point since November.

The market experienced a decline after President Donald Trump announced new trade tariffs which included 25% duties on Canadian and Mexican imports and 10% duties on Chinese products starting on Tuesday.

The United States conducts annual trades exceeding $1.6 trillion with these three nations. The tariffs activated market responses from Canada Mexico and China who pledged retaliatory measures that caused additional investor uncertainty.

During uncertain periods like this one Chris Weston from Pepperstone explains that crypto markets function as a “risk proxy.” The current trade conflict between nations creates economic uncertainties about price inflation and corporate financial performance and overall market expansion.

The crypto market saw $1.79 billion in liquidations within 24 hours following Trump’s tariff announcement. Over 450,000 traders were liquidated. Long positions accounted for $1.57 billion, while short positions totaled $219 million.

Bitcoin reached its highest value at $107,071.86 on January 20 after Trump won the election because investors believed new crypto regulations would be favorable. The slow pace of regulatory changes brings forth disappointing news to investors.

Despite the short-term drop, many investors still view Bitcoin as a hedge against inflation and instability. Financial experts closely observe Bitcoin’s position at the $90,000 mark.

The long-term Bitcoin market depends on global economic conditions and trade conflicts even though a price fall might trigger additional market losses.