The Central Bank of Nigeria (CBN) has reduced its initial restriction on international oil companies operating in the country from repatriating cash revenues.

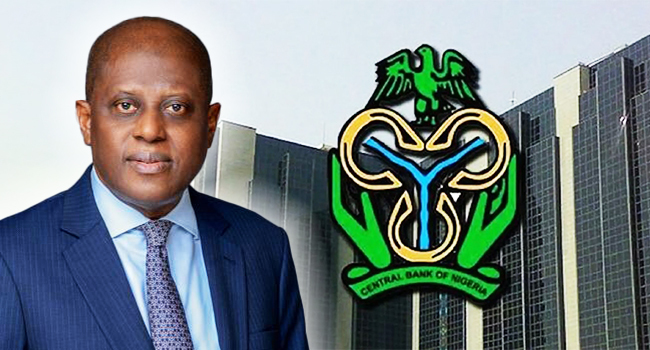

In a circular dated May 6, 2024, issued by Hassan Mahmud, Director, Trade and Exchange Department, the apex bank stated that oil corporations can now spend 50% of their repatriated export revenues on financial liabilities.

In February, the central bank prohibited international oil corporations from repatriating 100% of their foreign exchange profits to their parent companies overseas at once.

The apex bank had stated that overseas oil businesses could repatriate 50% of their revenues in the first instance and the remaining half after 90 days.

However, in its new directive, the CBN said, “Following the recent enquiries by banks and other stakeholders on our circular referenced TED/FEM/PUB/FPC/001/004, in respect of Cash Pooling requests by banks on behalf of IOCs, we provide further clarifications as follows:

“The initial 50% of the repatriated proceeds can be pooled immediately or as at when required. Banks may submit the request for cash pooling ahead of the expected date of receipt, supported by the required documentations, for approval by the Central Bank of Nigeria,” the apex bank said.

“The 50% balance of the repatriated export proceeds could be used to settle financial obligations in Nigeria, whenever required, during the prescribed 90-day period.”

The CBN said petroleum profit tax, royalty, domestic contractor invoices, cash call, domestic loan principal and interest payment, transation taxes, education tax and forex sales at the Nigerian Foreign Exchange Market are eligible for settlement from the balance 50%.