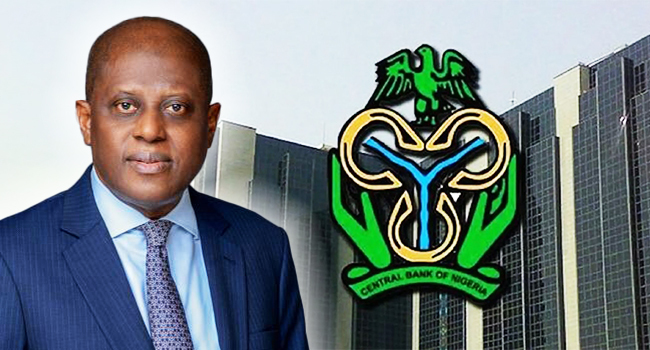

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, announced that the country recorded a total foreign exchange inflow of about $24 billion in the first quarter of 2024.

Cardoso made this statement during an interview with Bloomberg TV on Tuesday in London.

He noted that this inflow is approximately 50 percent higher than the inflows recorded in previous quarters up to 2021.

The governor also asserted that the days of excessive naira volatility are over, emphasizing the positive impact of the monetary policy tools employed by the apex bank to address challenges in the forex market.

He explained that inflationary pressure has begun to decrease due to the bank’s policy measures, which aim to lower the current inflation rate of 33.69 percent.

In a 20-minute interview, Cardoso highlighted a deceleration in the month-on-month inflation rates, calling it a positive development.

He assured that the Monetary Policy Committee members are vigilant in monitoring inflation trends and are committed to moderating inflation numbers.

He said, “The MPC has been very clear in stating that they see inflation as a major impediment to the future of Nigeria and would do everything possible to ensure that they keep inflation in check and bring it down as reasonably as they can. I don’t see that changing. So far from what we’re seeing, there’s a deceleration in inflation rates, which is good news. And my intuition is that with the measures that have been taken in the recent past, and with the confidence of the MPC members to watch the interest rate trajectory very closely. We should see a continuation of the moderation in the inflation rate.”

“Again, let’s watch the numbers but my intuition is that the MPC is determined to ensure that they put inflation in control.

Moreover, the governor refused to be drawn into whether this could signal the end of the tightening cycle that began in May 2022, when the central bank’s monetary policy committee meets in mid-July.

“Data will direct whether they see further hikes or not. The MPC has been very clear in stating that they see inflation as a major impediment to the future of Nigeria, and they will do everything possible to ensure that they keep inflation in ch and k bring it down as reasonably as they can and I don’t see that changing.”

“Let’s not forget that the MPC is an independent-minded group of people who deal with data. So, what I will say is that depending on what data they see at a particular point in time will direct how they see the hikes or not,” he added.

On the relative stability enjoyed in the exchange market, the former Lagos commissioner for Finance said the bank was relatively pleased with the progress it has made in stabilising the naira and would encourage measures to drive down the rates, adding that the worst was over for the Naira’s fluctuations.

Cardoso’s optimism stems from the CBN’s multi-pronged approach to stabilizing the naira before the recent interventions, speculation and manipulation in the FX forward contract market were contributing to naira volatility.

“We do believe that we have more or less seen the worst in terms of volatility. You recall that months ago when I assumed office in September of 2023, we did have a crisis on our hands and the naira was, you know headed in a direction that everybody didn’t like.

“There was a lot of fear, panic, loss of confidence and trust. And it was vitally important that we addressed those issues of confidence and trust. We are relatively pleased with how far we have gotten up to now. In the past two, or three weeks, after a period of volatility, we have seen a lot of stability in the market and there has hardly been any movement in the currency.”

“Several things were done, which included appreciating the fact that there were a lot of distortions within the foreign exchange system that did not give people the confidence to want to invest or want to keep their money in Naira. Everybody exchanged into dollars and held dollars and we addressed those issues using a flurry of different circulars, addressing some to the banks and some to the operations of the system itself. One of which is the fact that more confidence was going to come back into the market. A lot of inflows have come back because there’s very little liquidity at the time.

“In terms of liquidity, especially on the foreign exchange side, we have seen an increase. The first quarter of this year has resulted in a total inflow of about $24bn. Now, this is almost about 40 to 50 per cent more than the quarters up to about 2021.”

Cardoso noted that the rise in FX liquidity in the first quarter of 2024 is the highest in any quarter since 2021.

“The tools are having a positive impact. So we believe that continuing on this trajectory, we believe that liquidity will continue to grow,” he noted.

Speaking further in the interview, Cardoso said the apex bank has set up a committee to facilitate more inflow of diaspora funds into the official FX market.

He said the committee reported directly to him with the sole objective of doubling the inflow of foreign exchange from the international monetary operations.

According to him, this committee has begun to yield positive outcomes with an increase in inflow from Nigerians in the diaspora.

“We’ve had a recognition of the huge role the Nigerian diasporans play in remitting tremendous amounts of money into the system over some time.

“We set up a committee which reports directly to me to double the amount of foreign exchange inflow coming from the IMTO who service that segment the autonomous players.

“Capital inflows are very important. And the reason why it is is that in the case of Nigeria, the pass-through from the foreign exchange rate into inflation is quite significant. We believe that this is an area outside of the normal day-to-day operations that NNPC and exporters will help in closing the gap.

“Already, it’s beginning to bring about results. Again, we are confident that with these kinds of measurements, liquidity will increase in our market,” Cardoso added.