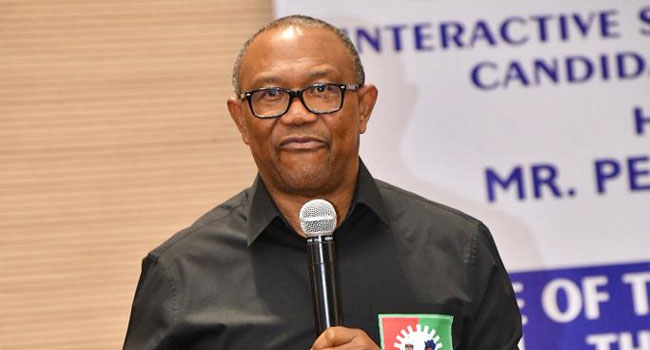

Regarding the recent withdrawal of Heritage Bank’s operating license by the Central Bank of Nigeria, Peter Obi, the 2023 Labour Party presidential candidate, urged swift measures to safeguard depositors and uphold trust in the banking sector.

In a statement released through X on Monday, Obi acknowledged the regulators’ assertion that the withdrawal was essential for bolstering financial stability. However, he underscored the extensive repercussions it would pose for depositors of Heritage Bank.

“The latest CBN’s revocation order on Heritage Bank’s operating license and subsequent appointment of NDIC as liquidator of its assets though affirmed by the regulators as necessary at this point to enhance financial stability, has a far-reaching impact on the bank’s depositors,” he stated.

Citing the harsh economic realities facing the country, Obi urged the Federal Government, through the Nigeria Deposit Insurance Corporation, to ensure the immediate payment of all depositors in full.

“I will urge the federal government via NDIC to ensure immediate payment of all depositors in Heritage Bank in full to help alleviate the prevailing hardship the people are going through in the country,” he said.

Obi highlighted the plight of individual savers and small and medium-sized enterprises (SMEs), who are already grappling with severe economic hardships and depend on their savings in the now-liquidated bank for survival.

“Many individual savers and SMEs are already groaning under severe negative effects of the economy and already living in abject poverty. These depositors depend on the savings they have in the now-liquidated bank to survive,” he added.

Obi warned that any attempt to deny or delay payment to these depositors could worsen their economic woes and lead to a crisis of confidence in the banking system.

“Any attempt to deny or delay payment to these depositors would worsen their economic woes and could lead to a crisis of confidence in the banking system,” he cautioned.

Emphasising the state of the nation’s economy, Obi stressed the importance of maintaining public trust in the financial system.

“Anything short of immediate and full payment can create panic in the banking sector which our already fragile economy cannot afford. On no account should the actions of government through the CBN destabilize the financial system or shake public confidence in the integrity of the system,” he asserted.

On Monday, the Central Bank of Nigeria (CBN) took immediate action to revoke the banking license of Heritage Bank Plc.

This decision came as a response to the bank’s inability to enhance its financial performance, posing a significant risk to financial stability. Sidi Ali, the Acting Director of the Corporate Communication Department at the apex bank, announced this in a statement.

Subsequently, the Nigeria Deposit Insurance Corporation (NDIC) declared that it has initiated the liquidation process of Heritage Bank Plc. NDIC has assured depositors of the failed bank that it will honor insured deposits up to N5 million.

Bashir Nuhu, the Director of Communication and Public Affairs at the corporation, stated in a release on Monday that the liquidation aligns with Section 55 Sub-sections 1 & 2 of the NDIC Act 2023.

The latest CBN’s revocation order on Heritage Bank’s operating license and subsequent appointment of NDIC as liquidator of its assets though affirmed by the regulators as necessary at this point to enhance financial stability, has a far-reaching impact on the bank’s depositors.

— Peter Obi (@PeterObi) June 3, 2024