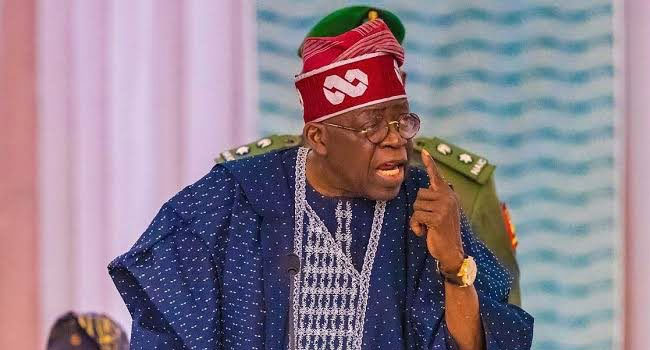

The Senate has received a communication from President Bola Tinubu requesting the consideration and passage of the proposed Fiscal Policy and Tax Reform Bill, aimed at aligning with the Federal Government’s ongoing financial reforms and improving tax compliance efficiency.

Similarly, the House of Representatives received four bills forwarded by the President. These include the Nigeria Tax Bill, Nigeria Tax Administration Bill, Nigeria Revenue Establishment Bill, and Joint Revenue Board Establishment Bill.

In his October 1, 2024 speech marking Nigeria’s 64th Independence Anniversary, Tinubu announced plans to submit several Economic Stabilisation Bills to the National Assembly.

“We are moving ahead with our fiscal policy reforms. To stimulate our productive capacity and create more jobs and prosperity, the Federal Executive Council approved the Economic Stabilisation Bills, which will now be transmitted to the National Assembly.

“These transformative bills will make our business environment more friendly, stimulate investment and reduce the tax burden on businesses and workers once they are passed into law,” he said.

Additionally, Taiwo Oyedele, the Chairman of the Presidential Taskforce on Fiscal Policy and Tax Reforms Committee, announced that the Withholding Tax Regulations 2024 has been officially gazetted.

“I do have some good news, the good news is that the withholding tax regulation has now been gazetted. So, the only reason it hasn’t been published today is because it is public holiday, so first thing tomorrow you will see a copy of the gazette and that provides a lot of relief not just for manufacturers but also every other business in terms of taking away some of the burdens of funding their working capital,” Oyedele said.